Japan’s recently appointed new prime minister Shigeru Ishiba has expressed his intention to pursue the same policies laid down by his predecessor, Fumio Kishida, to speed up the country’s sluggish economic recovery.

While Ishiba once criticized the Bank of Japan’s aggressive monetary easing, he now supports maintaining accommodative policies to stabilize the economy.

Monetary policy must remain accommodative as a trend given current economic conditions.

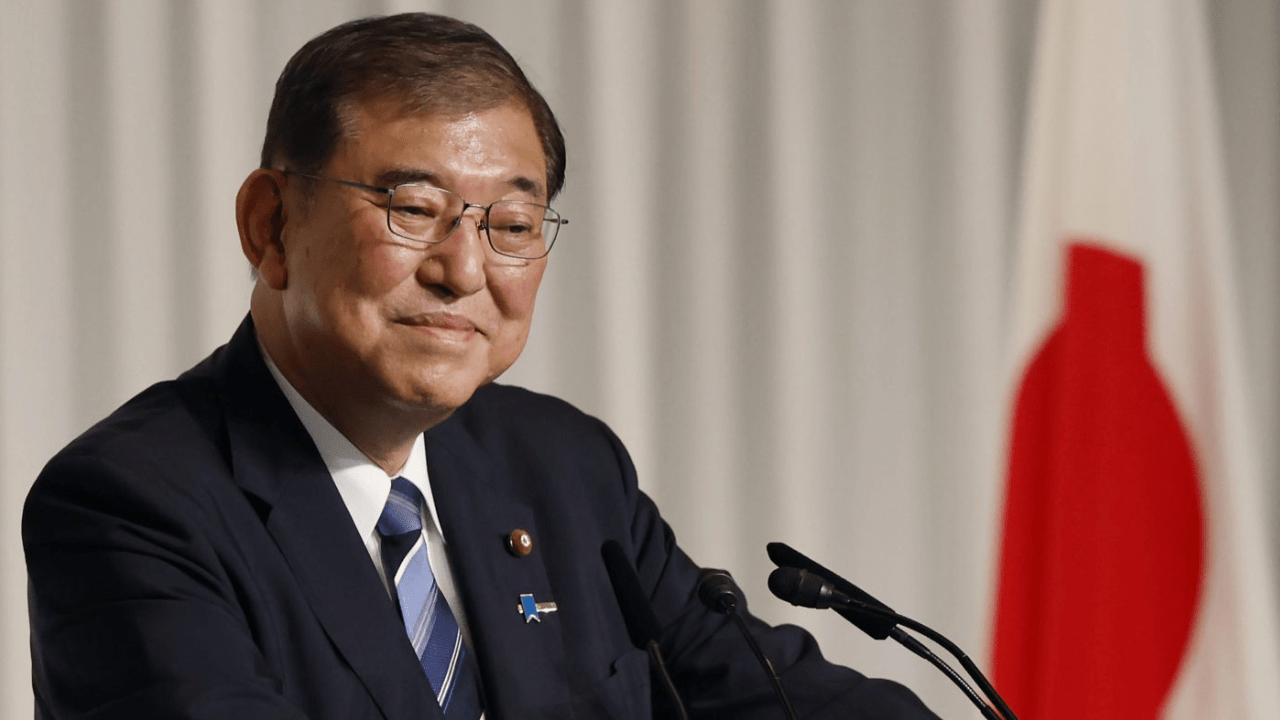

Japan’s Prime Minister Shigeru Ishiba

“Monetary policy must remain accommodative as a trend given current economic conditions,” the prime minister said.

Wall Street has shown strong support for Japan’s approach, recommending that Ishiba continue with policies focused on strengthening household incomes, deficit financing, quantitative easing, and structural reforms.

“Japan is a must-own country today for investors. The key is the continuity of these reforms and the continuity of these policies,” said Joseph Bae, co-CEO of global investment firm KKR, which has been a vocal advocate for policy continuity in Japan.

Despite Ishiba’s decision and Wall Street’s backing, Japan still faces tough challenges, such as reviving economic growth and managing the country’s substantial debt burden.