Goldman Sachs announced a definitive agreement to acquire Innovator Capital Management in a transaction valued at roughly $2 billion in cash and equity, pending regulatory approval. The deal, expected to close in the second quarter of 2026, will add $28 billion in assets under supervision and accelerate Goldman’s expansion into one of the fastest-growing segments of the exchange-traded fund market.

The acquisition brings Innovator’s full suite of 159 defined outcome ETFs, strategies that use options to create targeted return profiles and buffer downside risk, into Goldman’s global platform. Once integrated, Goldman Sachs Asset Management will oversee more than 215 ETF strategies worldwide, representing over $75 billion in assets and placing the firm among the top 10 active ETF providers globally.

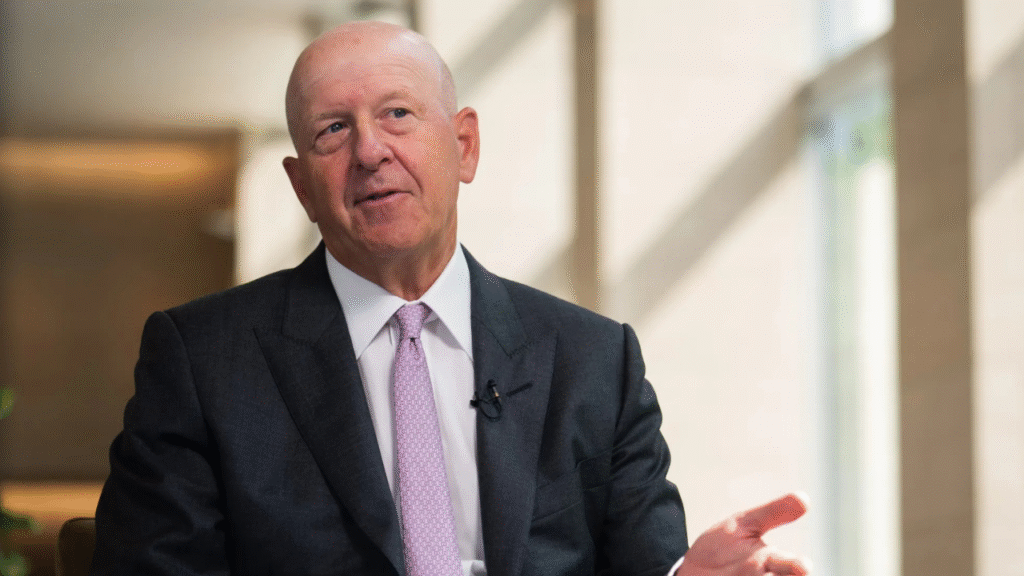

Goldman CEO David Solomon called active ETFs “one of the most dynamic and transformative segments of public markets,” noting that the deal strengthens the firm’s ability to offer outcome-driven investment solutions to a broader range of investors.

Active ETFs have grown rapidly in recent years, with global assets reaching $1.6 trillion and expanding at a compound annual rate of 47% since 2020. Defined outcome ETFs have grown even faster, at 66% annually, as investors seek customizable risk-return profiles within a tax-efficient ETF structure.

Innovator’s leadership team, including CEO Bruce Bond, co-founder John Southard, CIO Graham Day, and head of distribution Trevor Terrell, will join Goldman Sachs following the close. Goldman said investment processes and service providers will remain unchanged as teams integrate into its Third-Party Wealth and ETF divisions.

The acquisition aligns with Goldman Sachs Asset Management’s broader push to build durable, scalable revenue streams across ETFs, direct indexing, separately managed accounts, and alternative investments. The firm currently oversees $3.5 trillion across public and private markets and sees outcome-oriented products as a key driver of future demand among both institutional and retail clients.