Texas is positioning itself as a serious contender to Wall Street, with Dallas at the center of a sweeping realignment of America’s financial power base.

The New York Stock Exchange announced it will launch NYSE Texas, a fully electronic equities exchange headquartered in Dallas. The move includes the reincorporation of NYSE Chicago and underscores Texas’s rise as the state with the highest number of NYSE-listed companies—representing over $3.7 trillion in combined market capitalization.

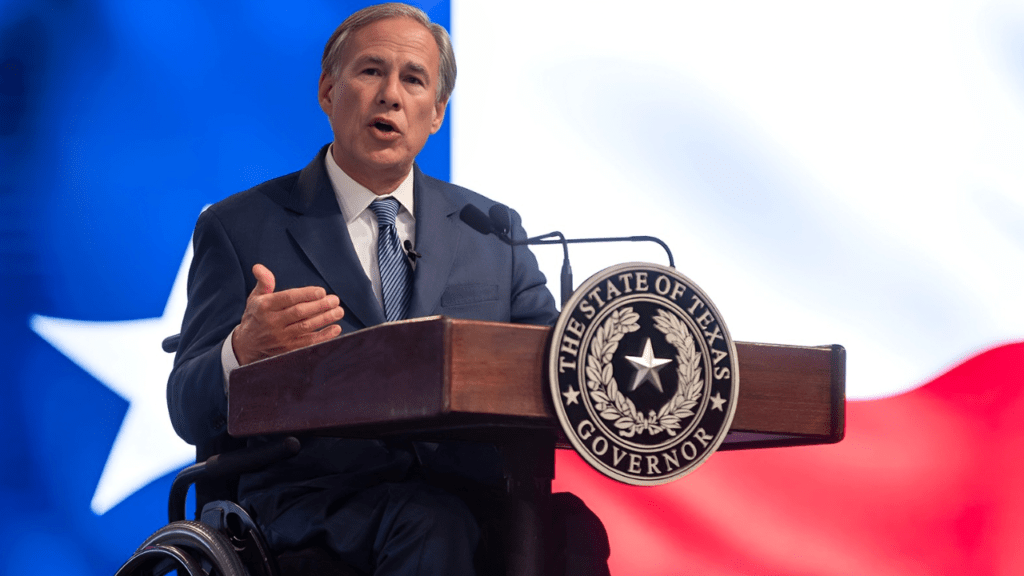

“Texas is the most powerful economy in the nation—and now we will become the financial capital of America,” said Governor Greg Abbott, framing the move as both symbolic and strategic.

The NYSE decision follows broader momentum. The newly announced Texas Stock Exchange (TXSE), also based in Dallas, has secured $161 million in funding from institutional giants like BlackRock, Citadel Securities, and Charles Schwab. Pending SEC approval, TXSE aims to launch in 2026, offering a modern listing platform for issuers seeking speed, transparency, and regional reach.

Nasdaq has also deepened its Texas presence. In March, it announced a new regional HQ in Dallas to serve more than 2,000 financial institutions, including 200 Nasdaq-listed companies representing nearly $2 trillion in market cap. The move builds on its existing footprint in Austin.

Policy advantages and infrastructure have helped fuel Texas’s momentum. The state’s lack of personal income tax, streamlined regulatory environment, and the recent launch of Texas Business Courts in 2024—modeled after Delaware’s Court of Chancery—are seen as major draws for corporate legal efficiency.

Dallas, now often referred to as “Y’all Street,” offers both scalability and affordability—traits that legacy financial centers like New York and San Francisco struggle to match.

While questions around trading volume and liquidity remain, analysts say the state’s financial ecosystem is primed to attract IPO candidates, private equity-backed firms, and regional issuers.

The convergence of NYSE Texas, TXSE, and Nasdaq in Dallas signals more than just expansion—it marks a reshaping of U.S. capital markets, with Texas no longer playing a supporting role, but emerging as a true peer to Wall Street.