Maryland Governor Wes Moore has unveiled the Delivering Economic Competitiveness and Advancing Development Efforts (DECADE) Act of 2026, a legislative proposal aimed at expanding private investment, modernizing economic development tools, and accelerating job creation across the state.

The proposal focuses on updating and extending programs administered by the Maryland Department of Commerce, with an emphasis on infrastructure development, workforce expansion, and support for high-growth “lighthouse industries.” State officials said the legislation builds on recent momentum that has already delivered billions in private-sector investment and thousands of new jobs.

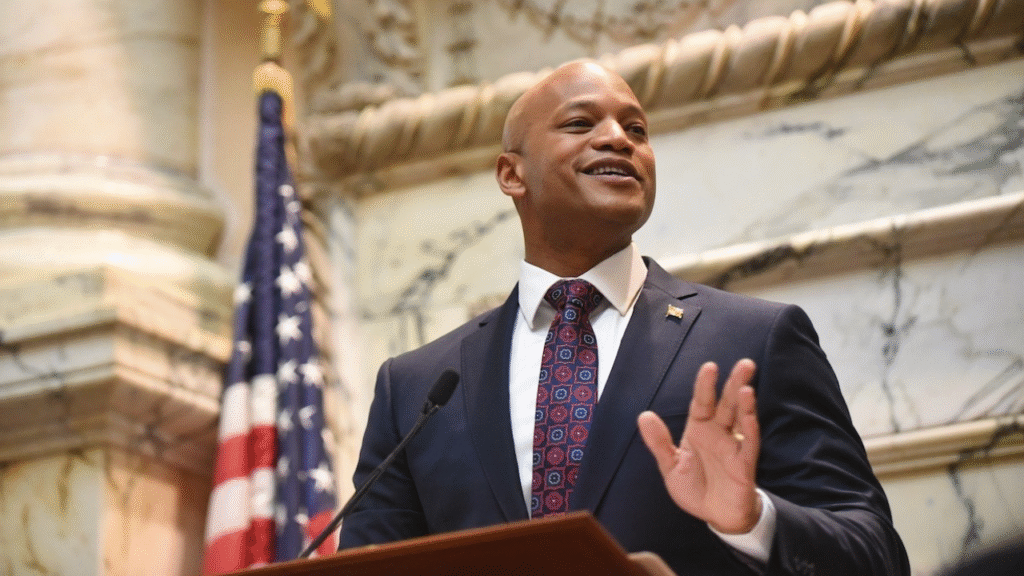

“You can’t have a competitive state without a growing economy,” Moore said, noting that the DECADE Act is designed to position Maryland to “lead the nation, drive innovation, and create new pathways to work, wages, and wealth.”

Key provisions include extending the Build Our Future Grant Program through 2030, modernizing the Regional Institution Strategic Enterprise (RISE) Zone program, and increasing flexibility within the state’s Strategic Fund to better support large-scale business attraction projects. The bill also proposes extending the Research and Development Tax Credit to 2031, prolonging the Employer Security Clearance Cost Tax Credit, and removing per-production caps on Maryland’s Film Production Activity Tax Credit to attract larger film and media projects.

The DECADE Act follows a strong year for economic development in Maryland. In 2025, the Department of Commerce awarded nearly $174 million to companies, supporting more than 4,800 jobs. The Moore administration also secured over $10 billion in private investment, including a $2 billion expansion by AstraZeneca and new life sciences commitments from Samsung Biologics.

State lawmakers said the proposal reflects a broader effort to reduce reliance on federal spending, strengthen Maryland’s competitive position, and create long-term, sustainable economic growth.